Overview

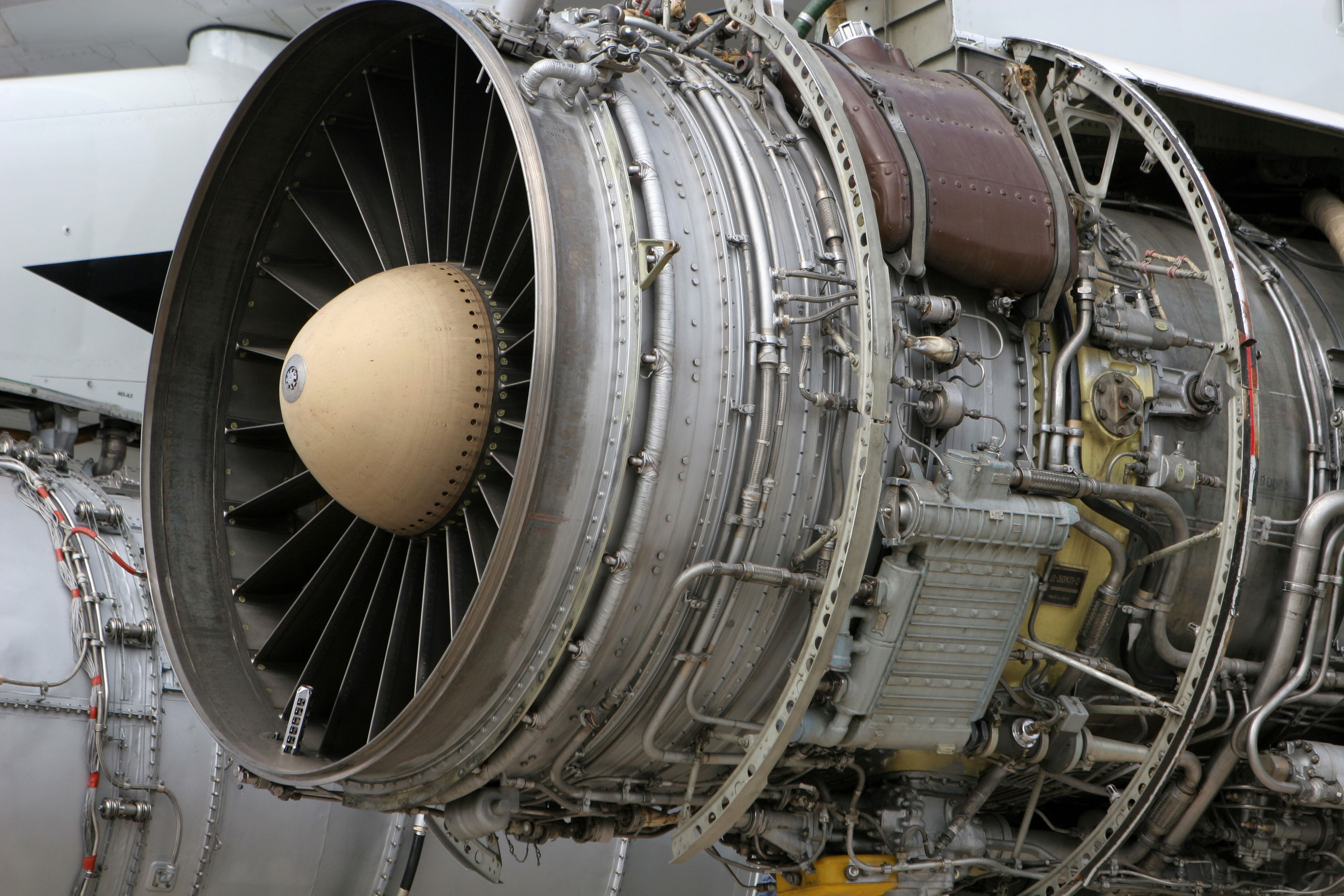

Headquartered in Newburyport, MA, Berkshire Manufactured Products supplies mission critical jet engine components for the aerospace industry. Berkshire is well-known worldwide among the significant aircraft engine OEMs for providing a one-stop alternative for parts, components, and assemblies that require integration of complex precision stamping, machining, and fabrication of difficult-to-manipulate metals and metal alloys.

Bigelow Assignment

Obtain the best new majority shareholder for the Company, and in doing so, provide a liquidity event for the current institutional shareholders and secure a value-added financial partner that would support management’s vision of future growth press applications know-how.

Challenges

Ownership Transition – The equity ownership of Berkshire had transitioned from its founding family to an institutional owner in the mid 1990’s. The institutional owner recruited a world class management team that grew the business to where it naturally needed a new majority investor with more access to capital and a deep understanding of the aerospace and defense industry.

Customer Concentration – As is the case with all aerospace engine suppliers, Berkshire’s sales were dominated by a handful of aircraft engine OEM’s resulting in sales concentration that many outsiders would view as risky.

“Bigelow’s combination of strategic thinking and analytical firepower served Berkshire well in bringing the right investor to the table and insuring that the transaction closed on the most favorable terms.” George Psyhojos, President & CEO Berkshire Manufactured Products, Inc.

Outcome

The ownership transition was realized with Relativity Capital, a newly formed private equity firm whose principals had significant experience and deep contacts in the defense and aerospace industries. Relativity recognized the tremendous value Berkshire represented in providing numerous replacement components across a broad cross section of jet engine platforms at the major OEMs.

Through Berkshire’s recapitalization, the institutional owner was able to monetize his seven year investment in Berkshire, while the management team increased their ownership percentage through this transaction with Relativity. Berkshire became Relativity’s first investment platform in their inaugural fund.

Relativity’s view of customer concentration was muted as they were familiar with the aerospace customer dynamic and would bring incremental relationships with new potential customers.