Overview

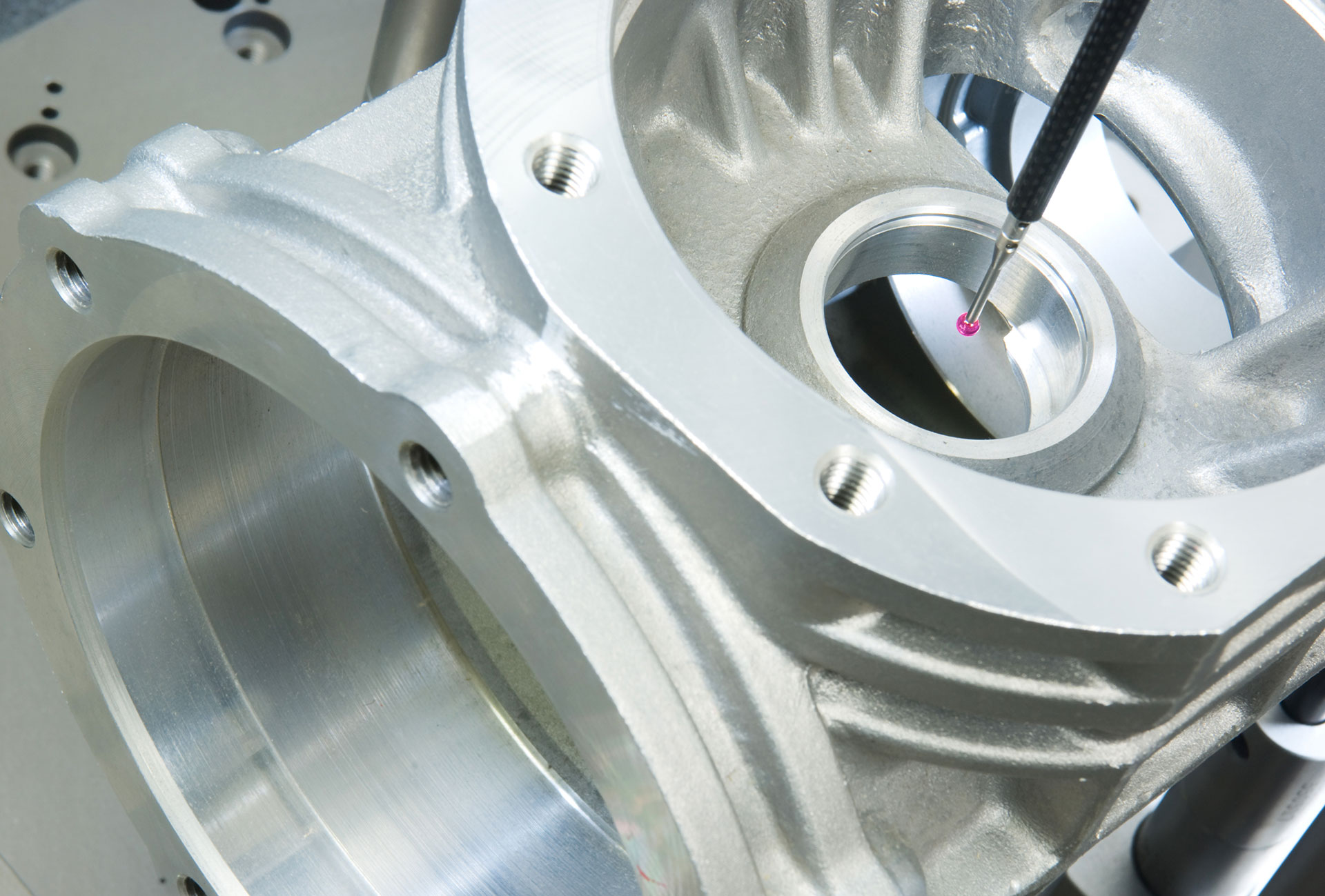

Dearborn is a leading manufacturer of high-precision tubular and rotating metal components for clients that specify exacting tolerances and unique configurations. The Company supplies critical technologies that enable the Digital Oilfield including sophisticated electronic housings for measure while drilling and logging while drilling directional drilling tools. The Company also manufactures turbine engine shafts for the aerospace and power generation industries.

Bigelow Assignment

Bigelow worked for several years helping to refine the shareholder’s objectives and positioning the Company for a possible capital gain opportunity. The shareholders concluded through Bigelow’s monitoring of the industry trends, combined with serious investor overtures, that the industry timing was right and asked Bigelow to proactively seek out the best new majority investor for the Company.

Challenges

Could Bigelow find a partner that would highly value Dearborn’s core deep hole drilling expertise, but was willing to serve multiple end-markets (including the more volatile oil patch business)? Would the new investor support the continued product expansion into power generation and turbine jet engine shafts? Would they simultaneously provide additional expansion capital?

“Bigelow became a trusted advisor over several years. They helped us understand our business and what investors would care about. Most importantly they were willing to work with us over time to figure out the right game plan. Bigelow waited… until I was ready… and when I said ‘Now,’ the transaction took less than 4 months to close.” Bill Findeisen, CEO & Shareholder Dearborn Precision Tubular Products, Inc.

“Bigelow was the anchor for the team that held us all together; not only emotionally, but also on every other level. I have never seen another firm like Bigelow who invests so much time and emotional energy into their client engagements.” Alan D. MacEwan, Esq., Company Counsel Verrill Dana LLP

Outcome

Bigelow created a rapid competitive process among several world class investors, resulting in multiple attractive offers. The Company chose to be acquired by Hunting Energy Services, a division of Hunting PLC (LSE: HTG). Hunting represented a unique fit as they are focused on products for the oil field services arena, but also support business units in multiple attractive end markets. This strategy was a hand and glove fit with Dearborn. In addition, a recent acquisition by Hunting created a synergistic cross-selling opportunity which was recognized by both management teams.

The transaction was structured creatively allowing the existing shareholders to carve–out and keep a small tube material tolling operation which was not valued as greatly by outside investors.

By joining the strong Hunting global platform, while keeping existing Dearborn management in place, and funding a planned facility expansion, the Shareholders ensured Dearborn’s longevity well beyond its original entrepreneurs.