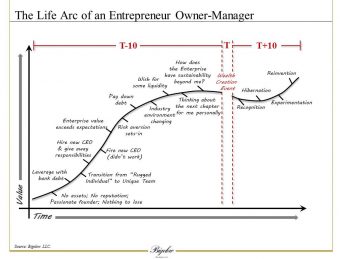

Bigelow’s sixth annual Forum was held on September 19th and 20th at Wentworth by the Sea Hotel in New Castle, NH. This year’s focus was on the “T” in the Life Arc of an Entrepreneur Owner-Manager – the wealth creation transaction.

Peter R. Worrell, a Bigelow Managing Director, opened the Forum with an overview of this year’s program and invited all participants to make a deposit into our bank of intellectual capital. Robert E. MacLeod, a Bigelow Managing Director, shared the historical latticework of the past Forums, layering the experiences, outside experts, original research, and intellectual property to construct the comprehensive story Bigelow builds with each successive Forum.

Richard C. Kimball, Senior Director of Bigelow, introduced our Guest Speaker, Daniel Pink. He is the author of five provocative books about changing the world of work, as well as a myriad of articles that have appeared in some of the country’s top business and news periodicals. His latest book, To Sell is Human: The Surprising Truth About Moving Others, offers a fresh look at the art and science of selling. He was a dynamic and enthusiastic speaker who completely engaged the audience.

Prior to the Forum, we invited participants to tell us about the most impactful “Lesson Learned from an Entrepreneur Owner-Manager” with whom they worked closely. Warren L. Widener, a Bigelow Vice President, provided an overview of predominant themes in the responses – Communication, Accountability, Talent, and Grit & Resilience. He also shared “Quotable Contributions” from the stories submitted.

Friday’s focus was on Bigelow’s experience in the world of the private transaction market and what is involved in navigating to the “T”. The sessions shared three unique areas of Bigelow’s M&A advisory experience.

Session I: SELLER BEWARE: The Private Transaction Market

with Mr. Peter R. Worrell

The first session highlighted the asymmetry of information, the asymmetry of experience, and the principal-agent problem between the public and private transaction markets. Worrell presented the following key insights:

- The public market is a buyer beware market; it works because it’s a highly organized and regulated market. It’s efficient.

- The private transaction market is a seller beware market; it has no stock exchange, no public financial reporting requirements, and no published research. It’s inefficient.

- Most Entrepreneur Owner-Managers (EOMs) are first time and only time entrants to the private transaction market.

The participants at the Forum have the information, the experience and the objectivity – and the responsibility – to level the playing field and proactively help EOMs to optimize their wealth creating transaction and create a permanent positive legacy.

Session II: Tick-Tock, Tick-Tock: Timing the EOM’s Capital Gain Event

with Mr. David C. Linton and Mr. Stephen R. McGee

The second session of the morning focused on the timing of the transaction. David Linton, a Bigelow Managing Director, shared the story of a client from the inception of the organization through the transaction and beyond, asking how we can understand the best timing for a wealth creation event.

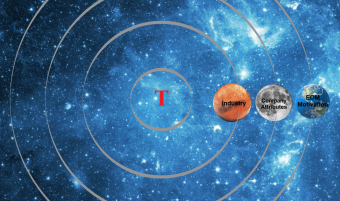

Linton shared that Bigelow has determined there are three primary drivers that go into the alchemy for optimal timing:

- Industry – Is your company’s industry currently in or out-of-favor with institutional investors? Classic “attracting characteristics” include a fragmented industry with no dominant players; a large addressable market for a product or service; and most importantly, immediate growing demand for a product or service.

- Company Attributes – Is the company’s degree of differentiation from its competition validated by high profit? Is the company’s value proposition so clear and entrenched any of its customers or prospects can easily recite it? How valuable is the company’s position in the industry supply chain? Is there a ready pipeline of growth opportunities for the company?

- EOM Motivation – Is the EOM still taking the requisite amount of risk in their decision-making and resource allocation in their business, or are they exhibiting a loss aversion bias? Is the EOM talking about their “next chapter” in their personal and professional lives? Can they articulate what they want to do after a sale or recapitalization? Do they acknowledge the current Enterprise Value of their business far exceeds what they ever hoped for or thought they might achieve?

Linton then asked if all of the three drivers need to be in full alignment, and shared analysis we had performed looking for these answers.

Diving into a real world dataset of owner-managed businesses we have worked with, we learned it is crucial that at least 2 of the 3 drivers be in place when thinking about timing, and it is PARAMOUNT that the industry be viewed as currently in favor.

Stephen R. McGee, a Bigelow Director, then invited the Forum participants to break into discussion groups and review a case study to determine what time it was for the company based on the three drivers. Lively debate, a surprise email and reporting out by each group followed.

Session III: Needles in the Haystack: The Journey to Find the Best Fit Investor

with Mr. Robert E. MacLeod and Mr. John-Michael Girald

Our third session focused on the journey to find the best next investor. MacLeod opened the session by sharing a recent Bigelow client story that illuminated four “Truths”:

- We can’t predict in advance who the best fit investor is.

- The best fit investor provides the highest value, preferred terms and conditions, and a legacy enhancing future. The best fit investor is attracted to all the key attributes of the company.

- We must create a market to identify the most compelled investors.

- Finding the best fit investor is a two-way street of exploration – a journey.

The session then switched over to feature a panel of EOMs who shared their personal stories. John-Michael Girald, a Bigelow Vice President, moderated the panel: Jim Seely, President & Chief Executive Officer of Residential Mortgage Services, Inc.; Barry Hibble, Chairman, Founder and former President of Micronics, Inc.; Lynne Mastera, Chief Financial Officer of Acushnet Rubber Co., D/B/A Precix; and David MacMahon, Former Chief Executive Officer of Maine Machine Products Company. These EOMs gave their perspectives and related their experiences on their transactions – the journey to the find the best fit investor, the timing and the lessons learned. They provided a forthright conversation and open, engaging Q&A.

In closing the Forum, Pete Worrell wove this year’s themes into the historical latticework presented at the opening of the program. He then made a suprise gift to all attendees of a pre-release copy of Enterprise Value: How the Best Owner-Managers Build Their Fortune, Capture Their Company’s Gains, and Create Their Legacy, Bigelow’s newly published book from McGraw Hill.